The latest data from the Toronto Regional Real Estate Board (TRREB) for August 2024 reveals some important trends for homebuyers, sellers, and investors in the Greater Toronto Area (GTA). Here’s a breakdown of the critical numbers and what they mean for you.

Home Sales and Listings: A Closer Look at the Numbers

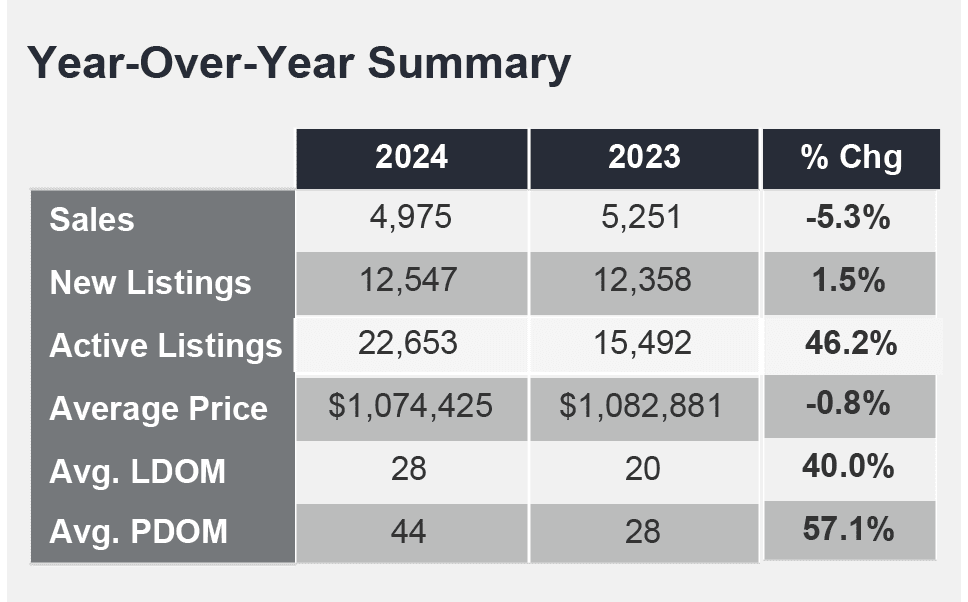

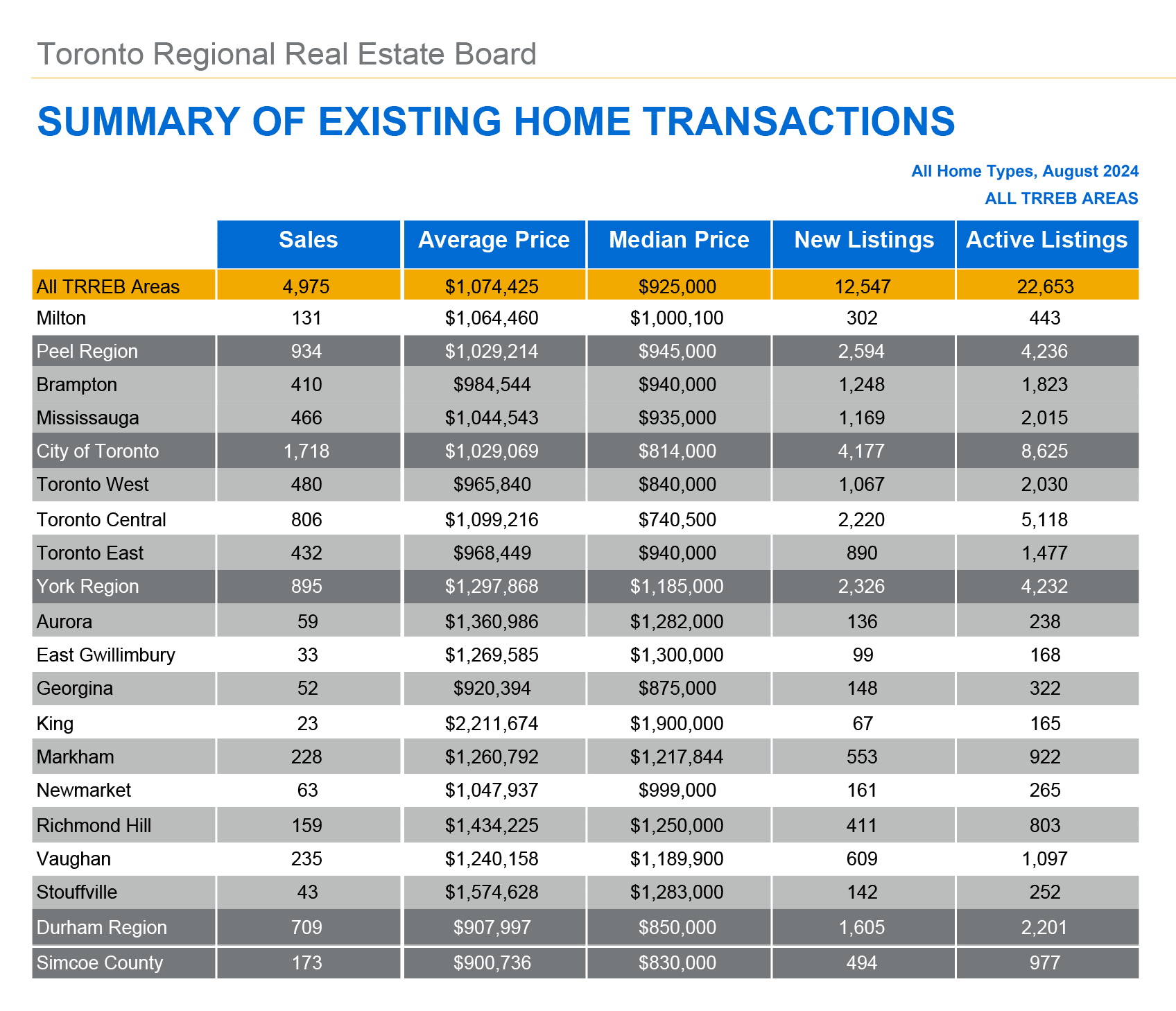

- Home Sales: 4,975 homes were sold in August 2024, a decrease of 5.3% compared to 5,251 homes sold in August 2023. However, on a seasonally adjusted basis, sales were up by 0.6% from July, indicating a slight month-over-month improvement.

- New Listings: The number of new listings increased to 12,547, up 1.5% year-over-year. This slight increase in new listings has kept the market well-supplied, providing more choices for potential buyers.

- Active Listings: The total number of active listings surged by 46% compared to August 2023. This jump has created a more balanced market, easing some of the pressure on prices.

Price Trends: What’s Happening with Home Prices?

- Average Selling Price: The average selling price for homes in the GTA was $1,074,425 in August 2024, down 0.8% from $1,082,881 in August 2023. On a month-over-month basis, the average selling price showed a slight decline, reflecting continued market adjustments.

- Home Price Index Composite Benchmark: This measure, which represents a “typical” home, fell by 4.6% year-over-year. The discrepancy between the Composite Benchmark and the average price suggests that more high-value properties, like detached homes, are influencing the average, while prices across more affordable segments are seeing a more pronounced dip.

Mortgage Rates and Affordability: What to Expect

- Interest Rates: Following the Canada interest rate cut in September 2024, the overnight rate is now at 4.25%, the third cut since June. This reduction is expected to further lower mortgage rates, especially variable rates, which could boost affordability and spur an increase in buying activity, particularly among first-time buyers.

- Impact on Buyers: As rates decrease, borrowing costs will drop, potentially leading to lower monthly mortgage payments. This trend is likely to encourage more first-time buyers to enter the market, especially in the condo segment, which remains more affordable than detached homes.

Future Market Outlook: Inventory and Price Stability

- Inventory Levels: With active listings up by 46% from last year, the market currently has a healthy level of inventory. However, TRREB experts believe that this elevated supply will eventually decrease as demand gradually picks up.

- Moderate Price Growth Expected: Due to the ample choice available in the market, price growth is expected to remain moderate in the short term, even as demand increases in 2025. Buyers and investors should take advantage of this period to find favorable deals.

Key Takeaways

- For Buyers: The current market conditions offer an excellent opportunity for first-time buyers, particularly in the condo market, where affordability is improving thanks to interest rate cuts in July 2024 and the new 30-year mortgage plan.

- For Sellers: While the market is competitive, there is still demand, especially for well-priced and well-maintained properties. Sellers may need to be strategic in their pricing to attract buyers.

- For Investors: With higher inventory levels and declining prices, this could be an opportune time to invest in GTA real estate, especially as borrowing costs are expected to drop further, with more Bank of Canada rate cuts likely.

While today’s elevated inventory levels may keep price growth moderate for now, the focus must remain on ensuring a diverse supply of affordable housing to meet the varied needs of GTA residents. As TRREB CEO John DiMichele points out, failure to do so could drive people away from the region, impacting local economic development.

In short, whether you are buying, selling, or investing, the current GTA real estate market offers opportunities – but staying informed and strategic will be key to making the most of them.

Stay Tuned: We’ll keep you updated on the latest market trends and how they could affect your next real estate move.

Contact Us

Equip yourself with the knowledge to navigate the complexities of the real estate landscape confidently.