The Toronto Regional Real Estate Board (TRREB) recently released its May 2024 market statistics, revealing a complex landscape for home buyers, sellers, and investors in the Greater Toronto Area (GTA). Despite a significant decline in home sales compared to last year, an increase in new listings and nuanced price adjustments highlight critical opportunities and challenges. With the recent announcement of an interest rate cut by the Bank of Canada, let’s delve into the key data points and what they mean for different stakeholders in the market.

Key Market Statistics

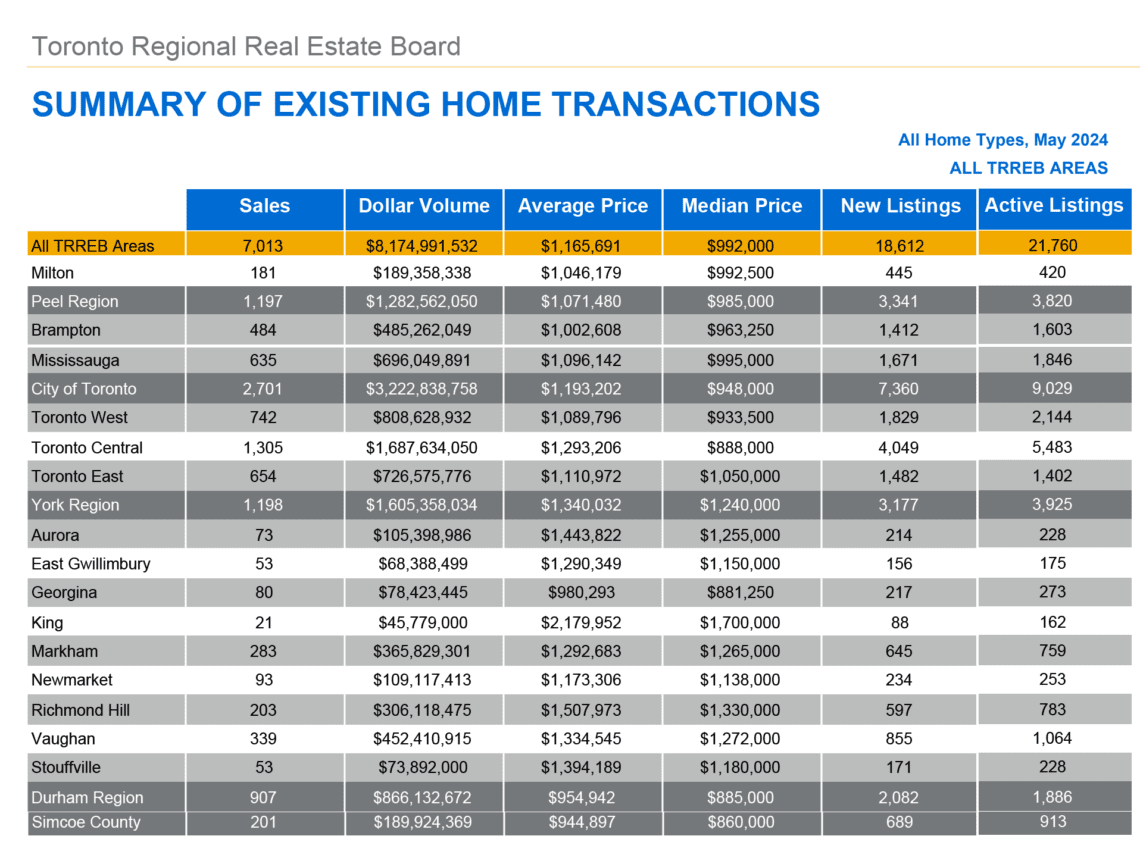

- Home Sales: In May 2024, 7,013 homes were sold, marking a 21.7% decrease from the 8,960 sales in May 2023. This decline reflects the market’s adjustment period following last year’s brief resurgence.

- New Listings: New listings saw a substantial increase of 21.1% year-over-year, with 18,612 properties hitting the market. This rise indicates growing anticipation among homeowners for a potential uptick in demand.

- Average Selling Price: The average selling price in the GTA dipped by 2.5% to $1,165,691, down from $1,195,409 in May 2023. However, on a seasonally adjusted monthly basis, there was a slight increase from April 2024.

Understanding the Trends

For Home Buyers

The recent interest rate cut by the Bank of Canada is a game-changer for potential home buyers. Lower borrowing costs can significantly enhance affordability, making it an opportune time to enter the market. TRREB President Jennifer Pearce notes that as borrowing costs decrease, more buyers, including many first-timers, are expected to enter the market. This influx will also ease the tight rental market by converting renters into homeowners.

Advice for Buyers:

- Act Swiftly: With mortgage rates declining, the window for affordable home buying is widening, but it’s crucial to act quickly before increased demand drives prices up.

- Leverage Negotiation Power: With an increase in new listings, buyers have more options and potentially more room for negotiation.

For Home Sellers

The increase in new listings suggests that many homeowners are eager to sell in anticipation of rising demand. However, the decline in sales and prices implies that sellers must be realistic about their pricing strategies. The recent interest rate cut could accelerate demand, but sellers should be prepared for a competitive market.

Advice for Sellers:

- Competitive Pricing: Price your home competitively to attract buyers in a market with abundant options.

- Enhance Appeal: Investing in home improvements and staging can make your property stand out in a crowded market.

For Investors

The Toronto real estate market’s fluctuations provide both risks and opportunities for investors. The decline in average prices might be seen as a buying opportunity, particularly for those looking to invest in rental properties. With the interest rate cut, the market is poised for increased activity, potentially driving rental demand and property values upward.

Advice for Investors:

- Long-term Perspective: Consider the long-term potential of properties, especially in neighborhoods with expected infrastructure improvements like the Eglinton Crosstown LRT.

- Diversify Portfolio: Diversifying your investments across different types of properties can mitigate risks associated with market volatility.

Market Outlook

The Bank of Canada’s recent interest rate cut is expected to spur demand significantly. TRREB Chief Market Analyst Jason Mercer highlighted that as borrowing costs trend lower, affordability will improve, likely leading to renewed upward pressure on home prices as competition between buyers increases. This development makes the current period critical for strategic planning by all market participants.

For All Stakeholders:

- Stay Informed: Keep abreast of economic indicators and policy changes that could impact the real estate market.

- Be Prepared: Flexibility and preparedness to act on market shifts will be key to navigating the evolving landscape.

Conclusion

The Greater Toronto Area’s real estate market is in a state of flux, with declining sales and prices juxtaposed against an increase in listings and a pivotal interest rate cut. For buyers, sellers, and investors, understanding these dynamics and responding strategically is essential. As the market adjusts, those who stay informed and act decisively will be best positioned to capitalize on emerging opportunities.

Stay Updated! Subscribe to our free weekly newsletter for real estate market insights, news, and reports delivered straight to your inbox.

Have Questions? Our real estate agents are ready to assist you. Call us today to speak to an agent in your area and learn more about how the recent rate drop impacts you.

Contact Us

Equip yourself with the knowledge to navigate the complexities of the 2024 real estate landscape confidently.