The GTA housing market experienced a notable shift in June 2024, with sales taking a hit compared to the previous year. Despite the Bank of Canada’s recent interest rate cut, which initially provided some relief, many potential buyers remained hesitant. Here’s a detailed breakdown of the latest trends and what they mean for homeowners, buyers, and sellers in the region.

Sales and Listings: A Year-Over-Year Comparison

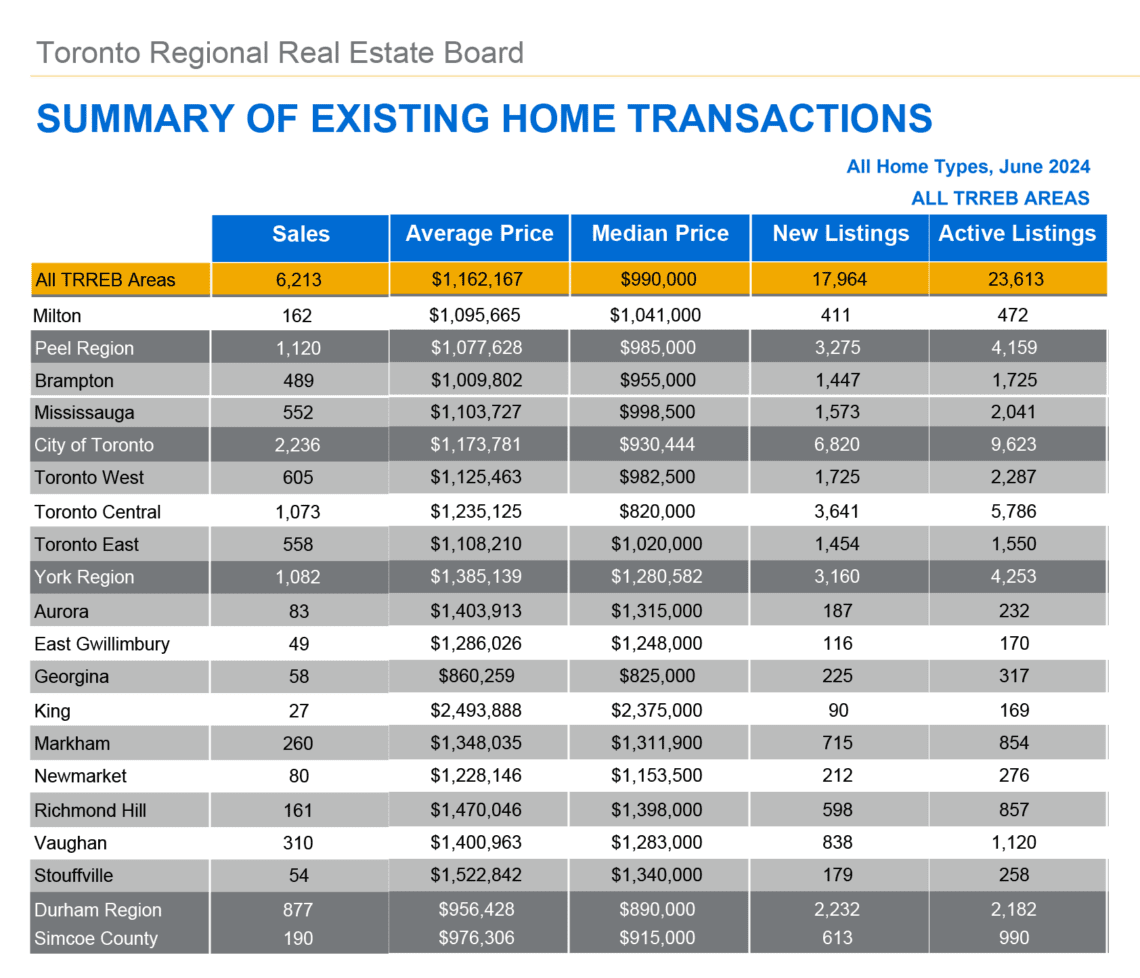

According to the Toronto Regional Real Estate Board (TRREB), home sales in the GTA totaled 6,213 in June 2024, marking a significant 16.4% decline from June 2023’s 7,429 sales. Interestingly, new listings saw a 12.3% year-over-year increase, reaching 17,964. This discrepancy between rising listings and falling sales has led to a well-supplied market, providing buyers with more options and negotiating power.

Prices: Holding Steady Amidst Market Fluctuations

The average selling price for homes in the GTA dipped slightly by 1.6%, settling at $1,162,167 compared to $1,181,002 in June 2023. Despite this year-over-year decline, the month-over-month analysis shows a positive trend, with both the MLS® Home Price Index Composite benchmark and the average selling price rising from May 2024 levels.

Interest Rates: Waiting for the Impact

TRREB President Jennifer Pearce highlighted that while the Bank of Canada’s rate cut last month offered some immediate relief, it hasn’t been sufficient to significantly boost home sales. Ipsos polling for TRREB indicates that cumulative rate cuts of at least 100 basis points might be necessary to motivate buyers to re-enter the market in large numbers.

Market Dynamics: Buyers’ Advantage

“The GTA housing market is currently well-supplied. Recent home buyers have benefitted from substantial choice and therefore negotiating power on price,” said TRREB Chief Market Analyst Jason Mercer. As borrowing costs potentially decrease further, elevated inventory levels are expected to prevent a sudden spike in selling prices, thus maintaining a balanced market.

Long-Term Outlook: Sustained Demand Amidst Strong Population Growth

Despite the short-term dip in sales due to high interest rates, the long-term demand for housing remains robust, driven by Ontario’s strong population growth. TRREB CEO John DiMichele emphasized the need for continuous government action to meet the province’s ambitious goal of building 1.5 million new homes by 2031. This includes removing red tape, reducing financial barriers to home construction, and minimizing housing taxes and development charges.

What This Means for Homeowners, Buyers, and Sellers

- Homeowners: With interest rates poised to potentially drop further, homeowners might see increased interest in their properties. However, current conditions favor buyers with ample listings to choose from.

- Buyers: The current market offers buyers a unique advantage with more listings and greater negotiating power. Those waiting for further rate cuts might find even better deals in the coming months.

- Sellers: Sellers may need to adjust their expectations and be prepared for negotiations, given the increased supply and selective buying behavior. However, as sales pick up with lower borrowing costs, the market could shift favorably for sellers.

Final Thoughts

The June 2024 housing market in the GTA presents a dynamic landscape, shaped by economic factors and market supply. While the immediate effects of interest rate cuts are still unfolding, the long-term outlook remains positive, driven by sustained demand and governmental support for housing development. For those navigating the market, staying informed and adaptable will be key to making the most of these evolving conditions.

Contact Us

Equip yourself with the knowledge to navigate the complexities of the real estate landscape confidently.