What’s Happening in the Ontario Housing Market? The Ontario housing market has experienced dramatic shifts over the past few years. New data from Teranet reveals crucial insights into how buyer trends, investor activity, and homeownership patterns are evolving. If you’re a homebuyer, seller, or investor in the Greater Toronto Area (GTA), understanding these trends in the Ontario housing market can help you make informed decisions.

Key Findings from Teranet’s Ontario Housing Market Insights Forum

Teranet’s recent Market Insights Forum provided a data-driven look at the Ontario housing market. Here are some of the biggest takeaways:

- Condos vs. Houses: While condos make up 25% of land transfers in Ontario, they dominate in Toronto, accounting for 60% of transactions.

- Buyer Shifts: First-time buyers are entering the market later, with the median age rising from 36 in 2014 to 40 in 2024.

- Investor Pullback: Multi-property owners (MPOs) are scaling back, especially those with large portfolios.

- Homeowners Staying Put: The average time homeowners keep their properties has increased, with condo owners holding onto units for over 8 years.

Toronto’s Condo Market: A Unique Trend in the Ontario Housing Market

Ontario’s real estate market is showing diverging trends, especially in Toronto. While some expected a broad housing recovery after recent interest rate changes, that hasn’t been the case across all property types.

- Condo Transfers Surge: Toronto condos saw a 20% year-over-year increase in ownership changes, compared to a 4% increase for non-condo properties.

- New Build Boom: A flood of 15,000 new condo units hit the market in 2024—78% more than in 2023. This influx may explain why resale condo sales slowed.

For buyers, this means more options in the condo market. For sellers, it suggests greater competition and potential price adjustments.

Investors Scaling Back – But Who’s Still Buying in the Ontario Housing Market?

Multi-property owners, once a dominant force in the market, are retreating. Previously, MPOs accounted for nearly a quarter of all transactions. However, new data shows a notable decline, especially among those with 11+ properties.

- Large Portfolio Investors Shrinking: In 2022, investors with 11+ properties made up 13% of Ontario MPOs. In 2024, that number dropped to 7.2%.

- Small-Scale Investors Still Active: The majority of MPOs (55%) own just two properties, indicating that individual investors still see real estate as a valuable asset.

- Cash Buyers on the Rise: A growing number of investors—30% in Toronto—are purchasing properties outright, avoiding mortgage costs altogether.

This suggests that well-funded investors are still confident in the Ontario housing market, even as larger players scale back.

Resale Market Pressures: Who’s Taking the Biggest Losses?

For those who bought at the peak in 2022 or 2023, recent market conditions have been challenging. Some sellers are now offloading properties at a loss.

- 1 in 4 Homes Sold at a Loss: Among properties bought in 2022 and resold in 2024, 25% sold for less than their purchase price.

- Regional Losses Vary: The median loss was $45,000 across Ontario and $56,000 in the GTA. Cottage country saw steeper declines, with Muskoka losses averaging $240,000.

This reinforces the importance of market timing and strategic investment choices.

First-Time Buyers in the Ontario Housing Market: A Changing Landscape

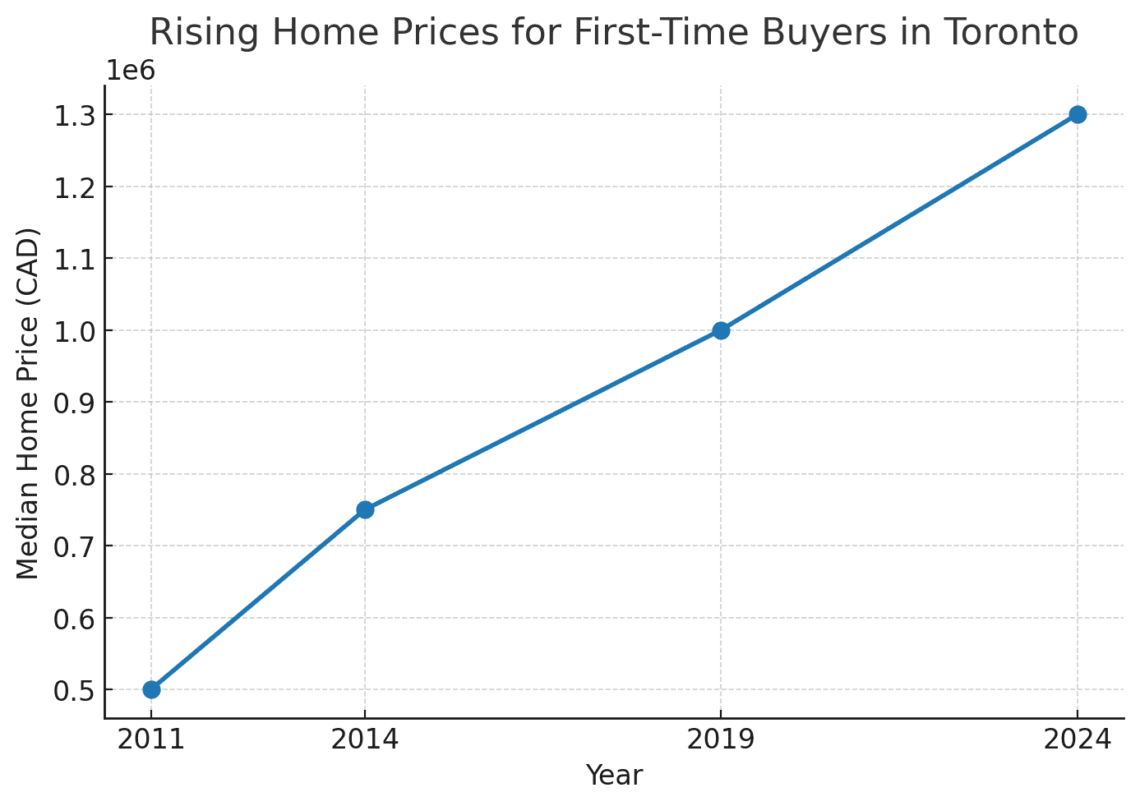

Rising home prices and economic uncertainty have made homeownership more challenging for first-time buyers.

- Rising Costs: The average first-time buyer’s condo price in Toronto rose from $500,000 in 2011 to $1.3 million in 2024.

- Delayed Homeownership: The median first-time buyer age increased from 36 in 2014 to 40 in 2024.

With affordability stretched, many first-time buyers are looking at alternative markets outside of the GTA.

Homeowners Holding Onto Properties Longer in the Ontario Housing Market

Market uncertainty and rising interest rates have led to longer homeownership periods.

- Condo holding periods increased from 7 years in 2015 to 8+ years in 2024.

- **Detached home holding periods rose from 11 years in 2015 to 12.5 years.

- **Toronto homeowners are staying put the longest—non-condo owners are now holding properties for nearly 18 years.

This shift suggests fewer listings in the near future, potentially sustaining home values.

What This Means for Those in the Ontario Housing Market

If you’re considering buying, selling, or investing in GTA real estate, these trends should be on your radar:

- Buyers: Expect more inventory in the condo market, but detached home options may remain tight.

- Sellers: Pricing strategically is key, as resale competition increases in certain segments.

- Investors: Smaller MPOs remain active, but large-scale investors are retreating. This could create opportunities for well-capitalized buyers.

Final Thoughts: How to Stay Ahead in a Shifting Market

Ontario’s real estate market is constantly evolving. Whether you’re a homebuyer, seller, or investor, staying informed is crucial.

Want expert insights tailored to your real estate goals? Follow our blog for the latest updates or contact us for personalized guidance on your next move!

Contact Us

Equip yourself with the knowledge to navigate the complexities of the real estate landscape confidently.