Toronto’s real estate market in 2024 has been nothing short of a rollercoaster. The year started with sluggish buyer demand and steep mortgage rates, but by midyear, the market shifted dramatically. For those dreaming of homeownership, this transformation opened new opportunities to step into Toronto’s competitive housing market. So, how much income did you actually need to afford a home in Toronto? Let’s break it down.

A Year of Change for Toronto’s Real Estate

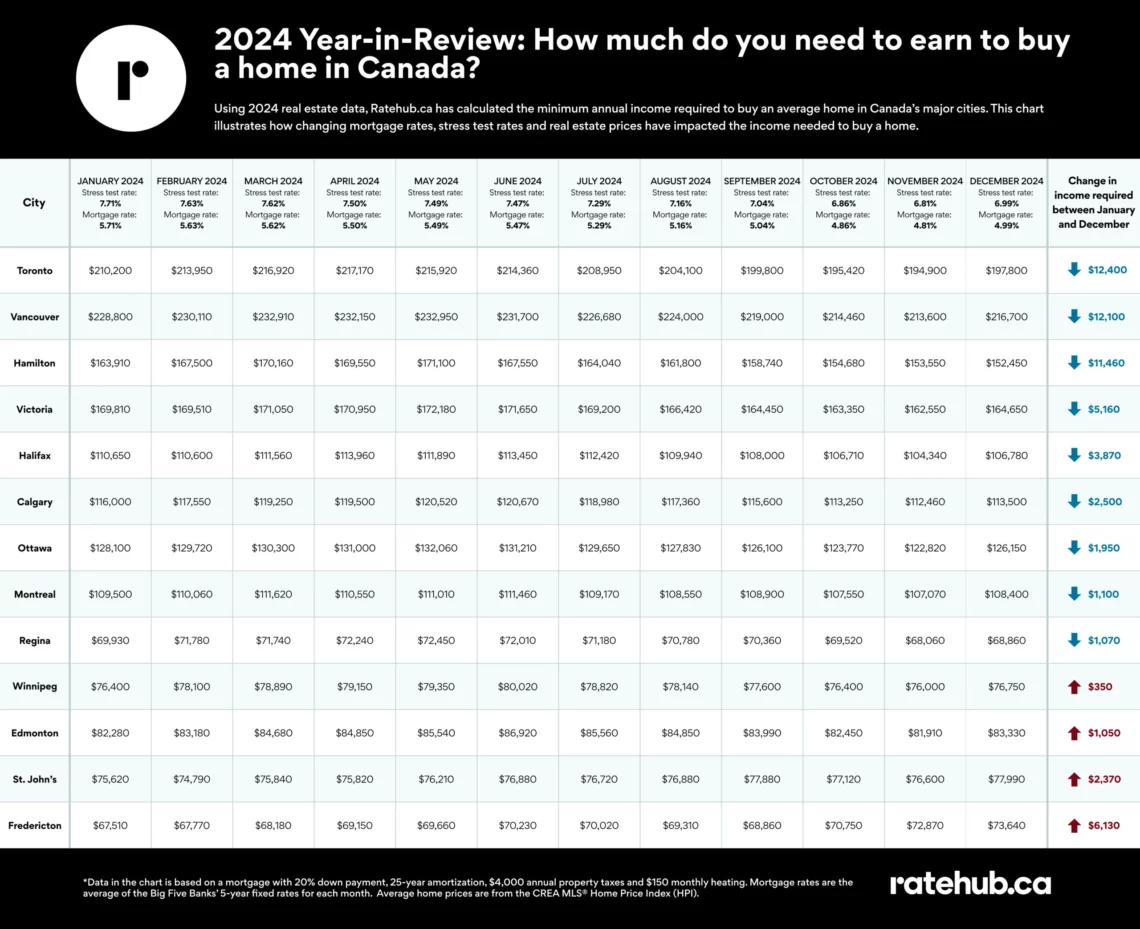

After years of soaring mortgage rates, relief finally arrived in 2024. The Bank of Canada cut its benchmark rate from 5% to 3.25% by December, creating a ripple effect across the housing market. Variable and fixed mortgage rates followed suit, with five-year fixed rates dropping from 5.71% to 4.99%. The mortgage stress test rate also eased from 7.71% to 6.99%, making borrowing more affordable for prospective buyers.

While home prices in Toronto remained relatively stable—starting at an average of $1,065,300 in January and ending at $1,061,900 in December—the reduction in borrowing costs significantly improved affordability.

Here’s What You Needed to Earn

According to Ratehub.ca’s December 2024 Affordability Report, the income required to purchase an average Toronto home fluctuated throughout the year. These shifts reflected changes in mortgage rates and other financial conditions:

- January: $210,200

- February: $213,950

- March: $216,920

- April: $217,170

- May: $215,920

- June: $214,360

- July: $208,950

- August: $204,100

- September: $199,800

- October: $195,420

- November: $194,900

- December: $197,800

These figures demonstrate how timing your purchase could save you tens of thousands in annual income requirements. Lower mortgage rates, even with stable home prices, made a significant difference for buyers.

What’s Next for Toronto’s Housing Market?

Looking ahead to 2025, the outlook is promising. Economists predict further rate cuts, potentially reducing the Bank of Canada’s benchmark rate to 2.5% to 2.75% by year-end. These cuts are expected to make variable mortgage rates even more affordable, spurring increased market activity.

The Canadian Real Estate Association (CREA) forecasts an 8.6% rise in home sales in 2025, with 532,704 transactions projected. By 2026, transactions could climb another 4.5% to 556,662, with the national average home price rising 4.7% year over year to $722,221 in 2025.

However, fixed mortgage rates remain less predictable. Influenced by bond markets, these rates are sensitive to economic uncertainty and could remain relatively high compared to variable rates.

What Does This Mean for You?

If you’ve been considering buying a home in Toronto, now could be the time to act. With borrowing costs dropping and home prices stabilizing, you may be able to secure a better deal than in recent years. Whether you’re a first-time buyer or planning to upgrade, preparation is key to making the most of this opportunity.

Don’t Miss Out: Follow our blog for expert insights and up-to-date market trends. Ready to take the next step? Contact us today for personalized advice and let us help you make your homeownership dreams a reality.

Contact Us

Equip yourself with the knowledge to navigate the complexities of the real estate landscape confidently.