As the Ontario cottage market sees significant shifts, both prospective buyers and sellers in the Greater Toronto Area (GTA) need to stay informed. The recent federal budget changes, including an increase in capital gains tax for secondary properties such as cottages, have noticeably influenced market dynamics. Here’s what you need to know to navigate these changes effectively.

Impact of Capital Gains Tax on Market Dynamics

The new capital gains tax regulations set to take effect on June 25th have already triggered an increase in cottage listings. While it’s challenging to pinpoint the exact impact of the tax change versus seasonal variations, there’s a clear uptick in market activity. This is an important factor for both current cottage owners and prospective buyers to consider, especially for those thinking about future estate planning and family legacies.

Estate Planning Becomes Crucial

With the tax changes, cottage owners are increasingly focusing on keeping their properties within the family rather than selling. This shift underscores the growing importance of sophisticated estate planning to navigate the new financial landscape effectively.

Market Shift from Sellers to Buyers

The Ontario cottage market is transitioning from a seller’s market to a buyer’s market. This shift is indicated by an increasing ratio of sellers to buyers, suggesting potential advantages for buyers such as more negotiation power and better pricing.

Predicting Price Trends

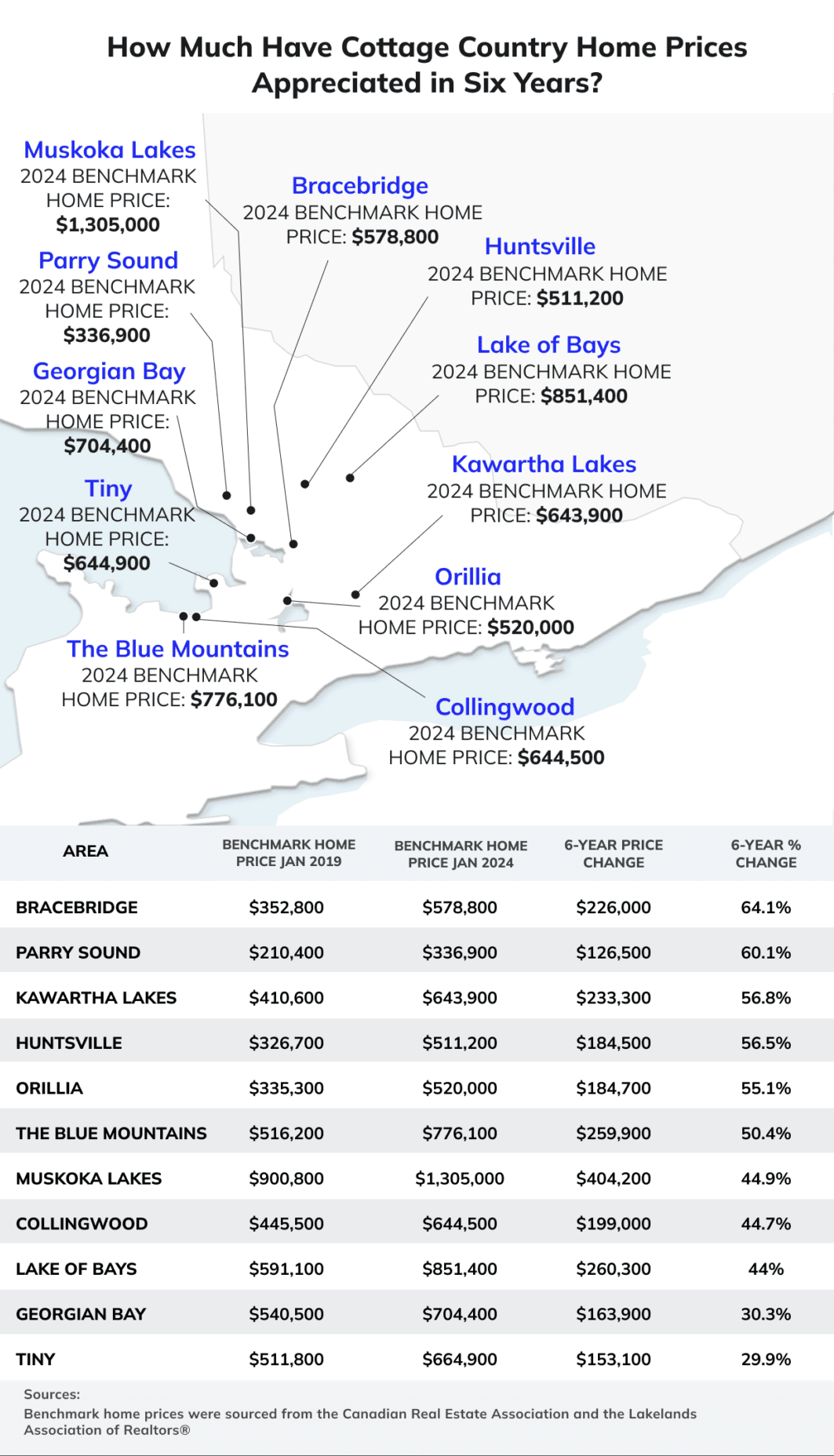

The market adjustment following the pandemic’s peak has led to a cooling of prices, particularly in the recreational property segment. The luxury market, previously buoyant, is now experiencing some price erosion due to additional taxes on foreign buyers. More notably, regular cottages and waterfront properties are witnessing significant drops in sales volume and price.

Changing Demographics and Property Preferences

The demographic profile of cottage buyers is evolving. The market now attracts a younger audience, ranging from 35 to 55 years old, enabled by the flexibility of remote work. This demographic shift is particularly focused on waterfront properties, which continue to be in higher demand compared to inland options.

The Appeal of Waterfront Properties

Despite broader market changes, waterfront properties remain highly desirable. Many individuals moving out of urban areas like the GTA are looking to invest in properties that offer direct access to water, viewing these as premium, worthwhile investments.

Conclusion: Navigating the Cottage Market

For GTA buyers, the current market conditions offer a unique opportunity to secure properties at potentially lower prices. Sellers may need to adjust their expectations and strategies to align with the shift towards a buyer’s market.

By understanding these trends and preparing accordingly, both buyers and sellers can make well-informed decisions that align with their long-term goals and financial strategies.

Staying ahead of market trends and seeking advice from real estate professionals can greatly assist in navigating the complexities of buying or selling a cottage in Ontario. Whether you’re aiming to purchase your dream retreat or sell a family property, being informed is your best strategy.

Free Buyer Consultation

Equip yourself with the knowledge to navigate the complexities of the 2024 real estate landscape confidently.