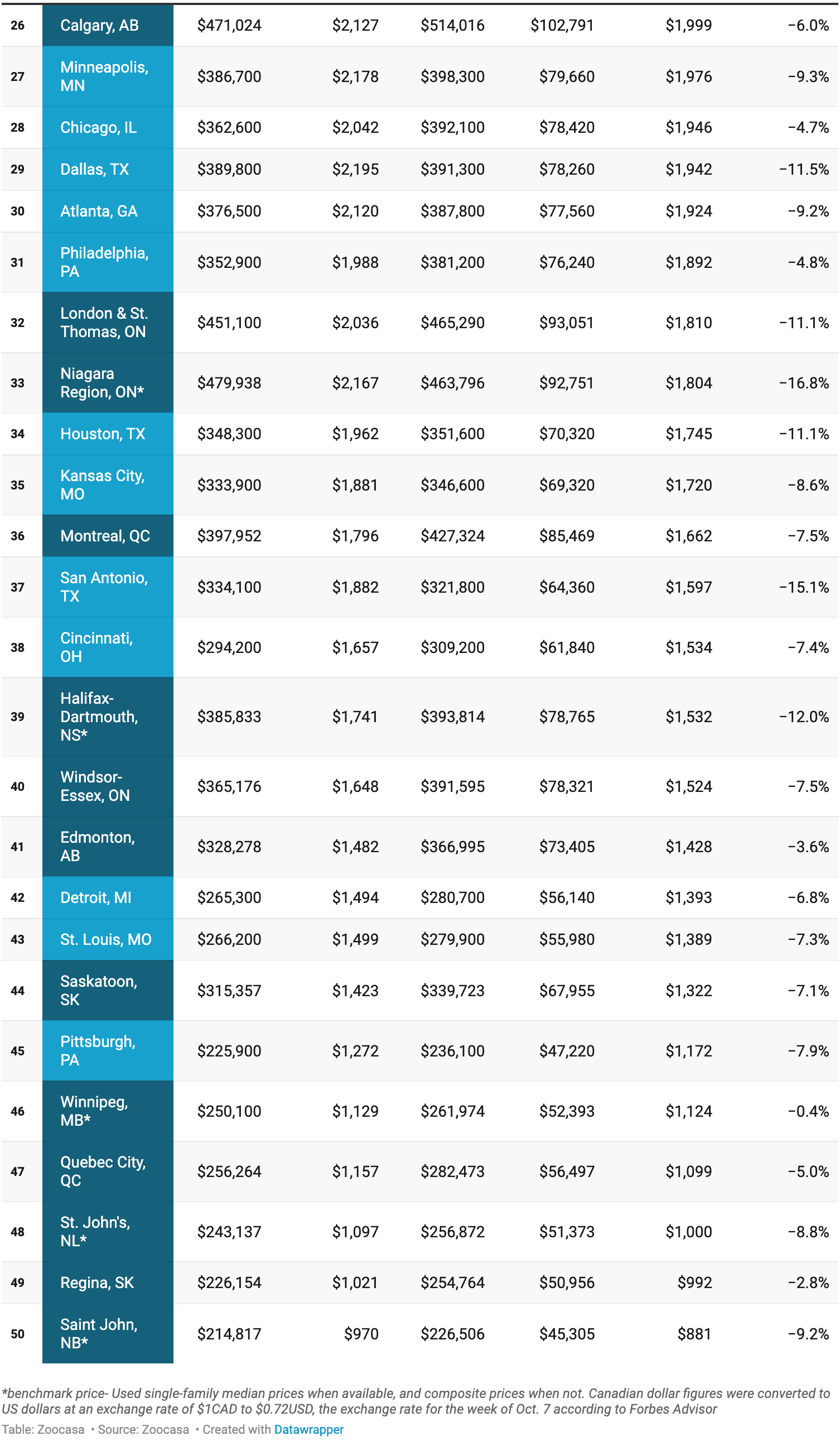

Have you ever wondered if housing is more affordable south of the border? With both Canada and the U.S. experiencing shifting mortgage rates, it’s a common question. So, is the grass really greener in the U.S.? Let’s dive into how much housing costs differ for homebuyers in Canada and the U.S. today.

Canada vs. U.S.: Who Has the Edge on Mortgage Payments?

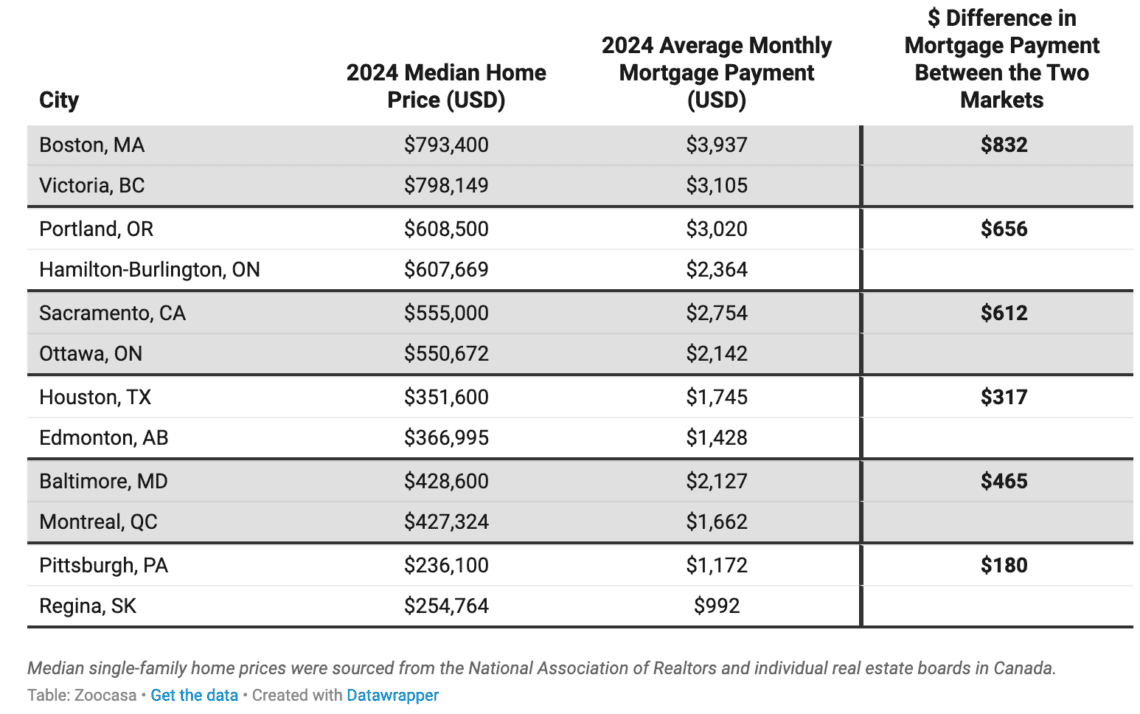

You might think that higher home prices in Canada automatically mean higher monthly mortgage payments, but the reality may surprise you. Thanks to more aggressive interest rate cuts by the Bank of Canada, Canadian homebuyers are enjoying more manageable mortgage payments, even in cities where home prices are higher than their U.S. counterparts.

Key Data:

- In Toronto, the average home price is $905,693, yet the average monthly mortgage payment is more affordable than cities like Pittsburgh, where the home price is much lower.

- In Montreal, homebuyers pay $465 less per month on mortgage payments than those in Baltimore, even though home prices are almost identical.

The West Coast Dilemma: High Prices Everywhere

West Coast cities on both sides of the border are notoriously expensive, but Canada still has the edge when it comes to mortgage affordability. In San Francisco, where median home prices are lower than in Vancouver, homeowners pay over $1,000 more per month. This difference is largely due to higher mortgage rates in the U.S.

Snapshot:

- San Francisco: $7,190 per month for a median-priced home.

- Vancouver: $5,702 per month for a home priced just slightly higher.

Story of Two Markets: Comparing Affordability

Let’s break it down further. In mid-priced Canadian cities like Hamilton-Burlington and Kitchener-Waterloo, the average monthly mortgage payment is actually lower than cities like Austin and Phoenix, where home prices are $100,000 less. The Canadian housing market continues to come out on top when comparing mortgage affordability.

Why Canadian Mortgage Payments Are Lower

One of the reasons Canada is leading in mortgage affordability is that Canadian rates are falling faster than U.S. rates. As of now, the average 5-year fixed mortgage rate in Canada is below 4.2%, whereas U.S. buyers are looking at over 6% for a 30-year fixed mortgage. These rate differences explain why Canadian buyers are seeing lower monthly payments, even in high-priced markets.

The Bottom Line: What This Means for You

Whether you’re thinking of buying in Canada or the U.S., housing affordability varies greatly. But in terms of mortgage payments, Canada seems to be the better deal right now. If you want to stay informed on housing trends that matter, follow our blog for the latest news and tips. Ready to discuss your next home purchase? Contact us today, and let’s find the best deal for you!

Contact Us

Equip yourself with the knowledge to navigate the complexities of the real estate landscape confidently.