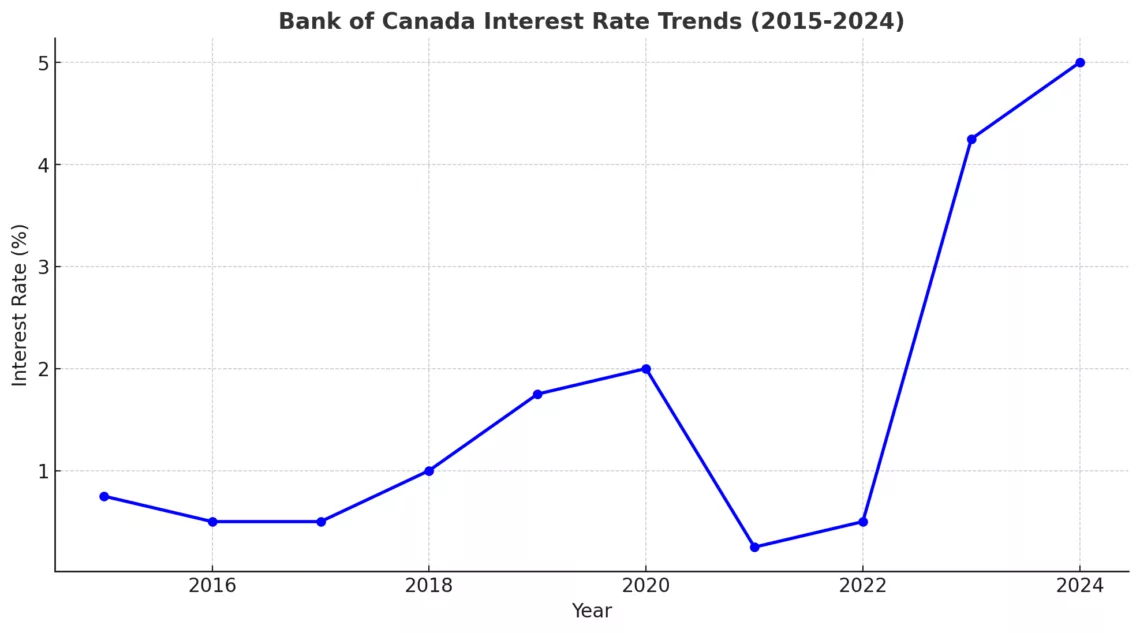

Canada’s economy is proving more resilient than expected, which could impact the Bank of Canada Interest Rate Forecast—a key factor for homebuyers, sellers, and real estate investors in the GTA.

RBC’s latest report suggests that interest rate cuts may not come as quickly as expected, thanks to stronger economic growth and inflation data. With mortgage rates still elevated, this shift could influence buying and selling decisions in the months ahead.

How Interest Rates Shape the GTA Housing Market

Mortgage rates directly affect affordability and demand. If the Bank of Canada holds off on cutting rates, buyers may need to adjust their financing plans, while sellers could see steady activity as buyers look to secure deals before any further changes.

Key insights from RBC’s latest data:

- Canada’s GDP grew by 1.5% in Q4 2024, exceeding expectations.

- Consumer spending surged 3%, the largest jump since 2021.

- Home sales and Residential Investment are on the rise, signaling a recovering market.

These factors indicate that, despite high rates, buyer confidence remains strong, making for a competitive real estate market this spring.

Will Bank Of Canada Drop Interest Rates in 2025?

While previous forecasts predicted rate cuts in early 2025, RBC now expects the Bank of Canada to hold steady in March, barring any unexpected economic shifts.

However, some risks remain:

- Business investments are slowing, which could impact long-term economic growth.

- Tariff uncertainties may still play a role in future rate decisions.

What Should Homebuyers and Sellers Do Now?

For homebuyers, staying ahead of market changes is crucial. If rates hold, locking in a competitive mortgage now could be a smart move before home prices adjust.

For sellers, buyer demand is still present, and well-priced properties are attracting serious interest. Listing sooner rather than later may help maximize opportunities before the next market shift.

Stay Informed, Stay Ahead

The next Bank of Canada interest rate forecast will be a key moment for the real estate market. Whether you’re buying, selling, or investing, staying informed can help you make the best decisions.

💡 Want expert real estate insights? Follow our blog for the latest updates or contact us today for personalized guidance!

Contact Us

Equip yourself with the knowledge to navigate the complexities of the real estate landscape confidently.