As affordability challenges continue across the GTA, understanding what each federal party is proposing for housing is essential. If you’re building, buying, or adjusting your house plans in Ontario, this 2025 election could have a direct impact on your future.

What the Parties Are Proposing – and Why It Matters

Whether you’re a first-time homebuyer in Vaughan, a custom home builder in Richmond Hill, or an investor exploring development opportunities in Toronto, these new federal housing strategies could change your path.

Each of the three main parties – Liberals, Conservatives, and the NDP has committed to plans that directly affect affordability, supply, infrastructure, and housing accessibility. Here’s a breakdown of the key promises.

Liberal Housing Plan: Support for Buyers and Builders

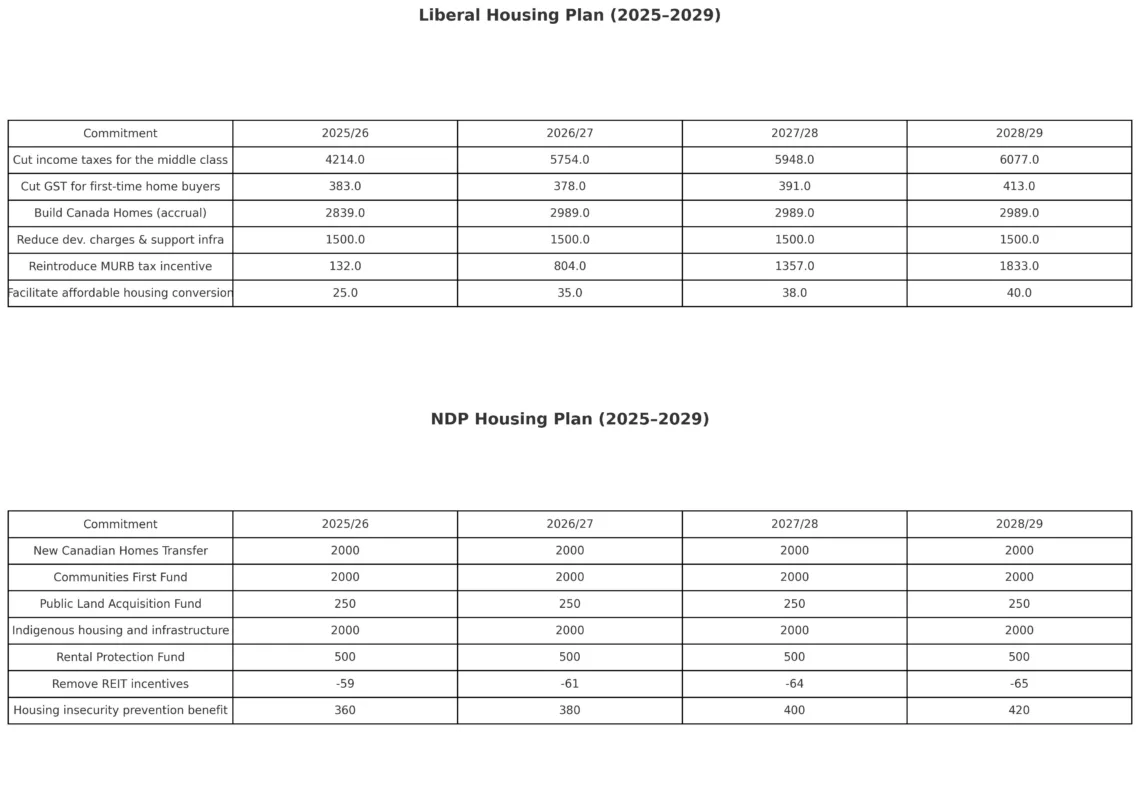

The Liberal Party is proposing over $36.8 billion in housing measures over four years, focusing on both affordability and new development.

📊 Key Commitments (2025 – 2029):

- Tax Cut: A 1% income tax reduction for the lowest bracket saving up to $825 annually for middle-class households

- GST Breaks: First-time homebuyers could save up to $50,000 on homes under $1M

- Build Canada Homes: A new federal agency to partner with private developers and boost supply

- Infrastructure Support: $1.5B annually to offset municipal development fees

- Incentives for Apartment Builds (MURB): Bringing back a proven 1970s rental incentive

- Conversion Grants: $138M committed to converting underused office space into homes

👉 These programs are designed to help make house plans in Ontario more achievable by lowering upfront costs and increasing supply.

You can explore the full breakdown here:

NDP Housing Plan: Community, Affordability, and Tenant Rights

The NDP proposes a $28B housing strategy that focuses on long-term affordability, rent control, and public development.

📊 Key Commitments (2025–2029):

- New Canadian Homes Transfer & Communities First Fund: Rewarding cities that fast-track new builds near transit

- $2B/year for Indigenous housing

- Public Land Acquisition Fund: Reserving land for non-market, rent-controlled housing

- Rental Protection Fund: Helping nonprofits buy and protect affordable rental units

- REIT Reform: Removing tax advantages for financial landlords

- National Rent Control & Tenant Protections

These measures aim to balance affordability with equity and protect existing renters while supporting the creation of new rental inventory especially in regions like the GTA where house plans in Ontario face land and zoning barriers.

What This Means for House Plans in Ontario

- Reduced development fees and tax rebates could lower project costs

- Streamlined zoning and incentives may open more buildable lots in urban areas

- GST exemptions and income tax reductions may reduce your upfront costs

- More affordable housing options could become available in key transit-connected areas

- Programs like MURB or the Rental Protection Fund may offer new avenues

- But REIT reforms under the NDP could limit returns for large-scale investors

Stay Ahead in Ontario’s Housing Market

The next few years will bring major shifts in real estate policy. Whether you’re drawing up custom blueprints, evaluating pre-construction opportunities, or helping clients enter the market, these platforms will shape the path forward for house plans in Ontario.

📩 Follow our blog for real-time insights, or

📞 Contact our team to learn how these proposals could influence your next move.

Contact Us

Equip yourself with the knowledge to navigate the complexities of the real estate landscape confidently.